Introduction

2020 has been a difficult year for everyone, both in the UK and overseas. Repeated lockdowns and restrictions on businesses, as well as coronavirus itself, have caused panic buying, cupboard filling, widespread foodservice closures and difficulty with labour on farm and in processing units. The strain placed on both food supply chains and consumers has been unprecedented in peacetime.

The impact on dairy supply chains became the subject of headlines as the first lockdown restrictions came into effect. Initially, stockpiling in retail gave way to longer term buoyancy as people moved their consumption in home and supermarkets saw double digit levels of growth. Difficulties arose as the abrupt closure of food service outlets meant the loss of that valuable market resulting in oversupply of milk. This was exacerbated by coinciding with the spring flush and processing capacity being full. As a result of this we saw distressing scenes of milk having to be tipped away on farm with no home.

Over time the supply chain has balanced out and the market has reached more equilibrium. Suppliers for food service have pivoted to retail and in some cases adopted new routes to market. However, the challenges remain as tiering restrictions continue and British consumers struggle to adapt to that very-overused phrase, the new normal.

This paper explores how dairy consumers have adapted over the course of this year, both in buying and consumption behaviour and in their attitudes and highlights the key challenges and opportunities for the coming year for dairy producers.

Out of home challenges

At the peak of the first lockdown, the number of out of home eating occasions had fallen by 62% compared to the same period last year. There was growth in in-home eating occasions at the same time of 30% but this was not enough to compensate for overall losses across the whole market.(1)

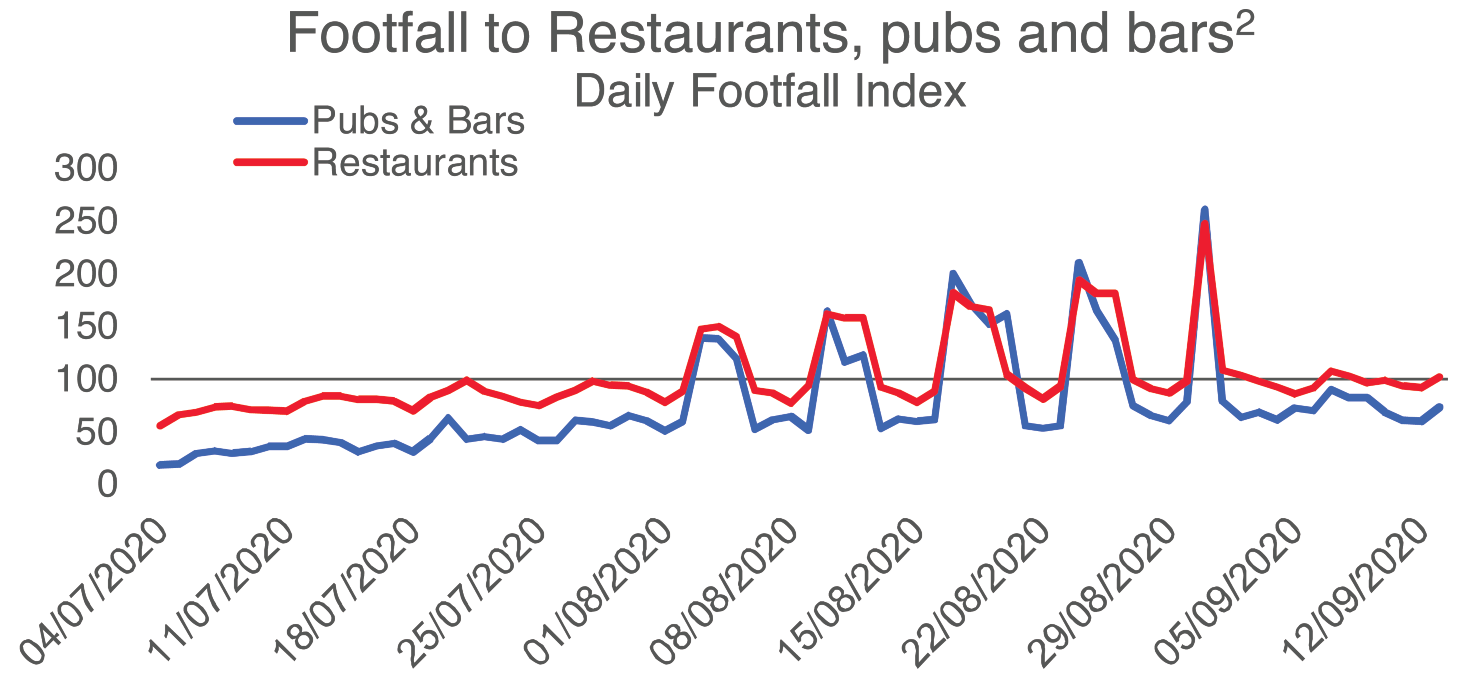

As the first lockdown eased and cases fell, the British government sought to encourage foot traffic back to retail with Rishi Sunak’s welcoming the Eat Out to Help out (EOTHO) scheme. This was moderately successful in encouraging consumers to return to eating out again. Kantar reported an additional 121m out of home occasions in 4 w/e 9 Aug, vs 4w/e 12 Jul 20. The uplift was particularly felt in Monday to Wednesday dining out occasions which grew by 177% in Aug vs Jul, compared to the average out of home market uplift of 27%. The number of people leaving their homes for the purpose of eating out rose from 9% in early July to 38% by the week of the August bank holiday, however these gains were short lived and immediately began to tail off with a sharper fall as new restrictions came into force in November.(3)

Figure 1. (2)

In September, when consumer confidence was at its highest, the vital coffee shop market was only seeing foot traffic of half the levels compared to before the pandemic.(4) We may expect to see the coffee market demonstrating resilience as we did after the 2008 recession, however, the structure of the market will not be quite the same as many outlets have permanently closed.

Figure 2.

Similarly, although we have seen movements to takeaway, with growth in menu items such as pizza, this has not been enough to offset the losses in food service. Pizza has seen a 20 million growth in occasions but burgers, overall, have lost 183 million occasions. As city centre traffic has diminished, food to go has also dwindled and cheese sandwiches have lost 52 million occasions.(5)

Even as restrictions start to ease again there will continue to be headwinds in food service. Over half of consumers (57%) (6) expect to be eating out less than before the pandemic. This is driven by both health and safety consideration but also economic necessity as the growth in unemployment and a shrinking economy are felt.

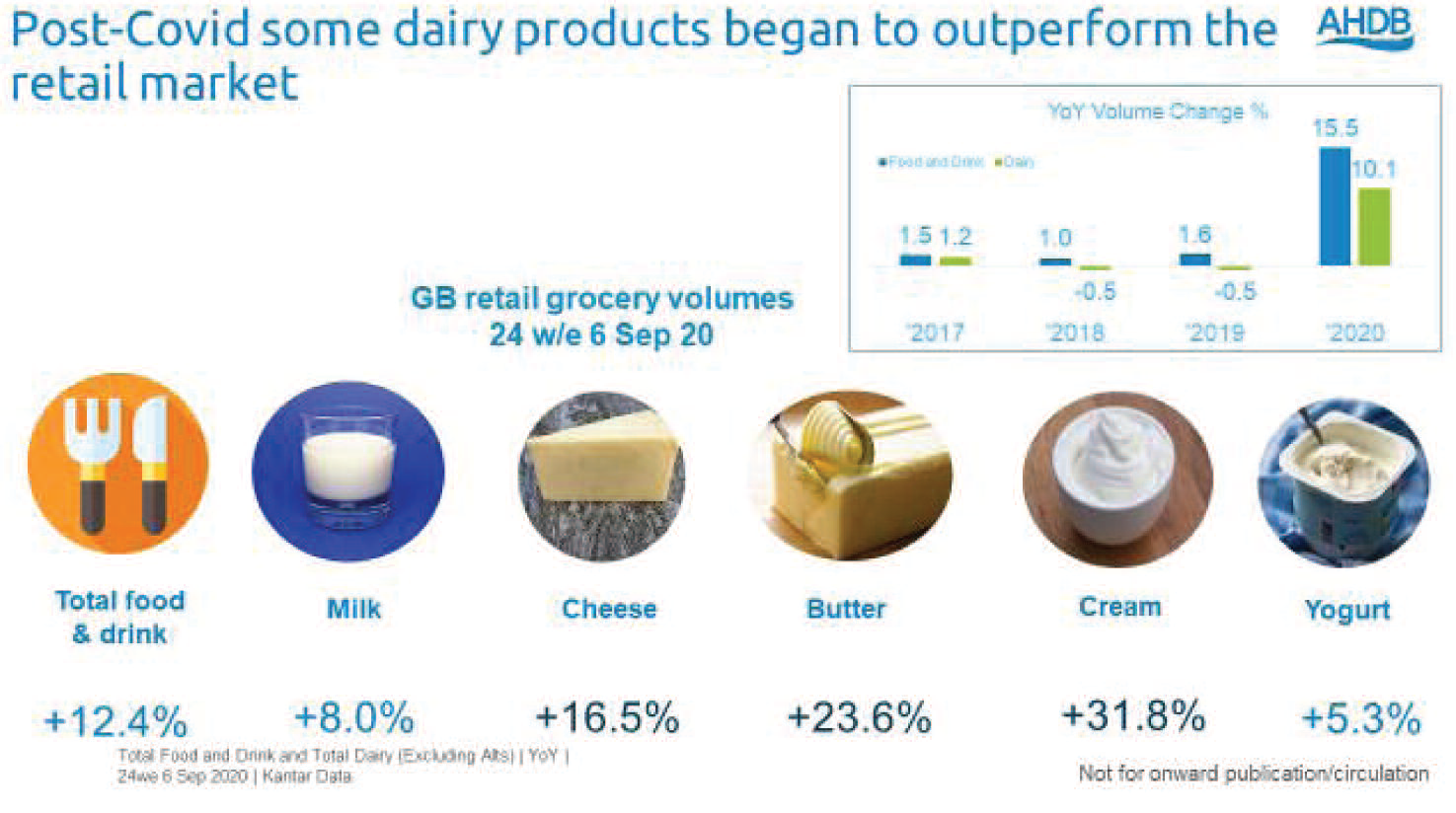

Growth in retail

As consumption moved into the home, retail volumes soared. After the initial stock piling and panic buying settled and confidence in the supply chain resumed, total food and drink volumes for the 24 w to 6th September 2020 grew by 12.4% year on year. Dairy products helped some of that growth with cheese up by 16.5% and butter and cream up by 23.5% and 31.8% respectively. Milk and yogurt has more sober levels of growth at 8% and 5.3%, but milk’s sheer size meant that in volume terms it accounted for the biggest portion of dairy growth.

The dairy alternatives market remained buoyant, driven by an extremely strong performance in oat milk, although alternatives remain a comparatively tiny part of the dairy market at 4%.

The key changes in behaviour driving dairy growth were the uplift in hot drinks in home, particularly tea (which had been seeing some decline in recent years) and lunches being consumed at home. This drove good levels of growth for both cheese and butter as sandwiches performed well. While there was much hype about baking banana bread and sourdough, baking itself only accounted for a small uplift in volumes, although more influential for categories like cream.

All categories of cheese, apart from individually portioned cheeses for lunchboxes performed well. Territorials saw the most growth overall, reversing the pattern of ongoing decline. Whilst cheddar as by far the largest type of cheese in the market accounted for the most volume growth, the most dramatic grower was mozzarella, boosting volumes by 48% year on year as consumers made their own pizza and other Italian dishes.

Changing attitudes

The Covid-19 pandemic has wrought some changes in how consumers feel about the food system. Three quarters believe that British farmers have done a good job in producing food for consumers during the crisis.(7) In a separate survey this year we found that trust in all parts of the supply chain had deepened to some extent with retailers and food service seeing the biggest uplifts (10% and 12% respectively).(8) Positivity towards agriculture had also improved from 62% to 66%, driven mainly by horticulture and pork.

A shift in balance of media reporting around red meat and dairy, due to the dominance of coronavirus coverage, has had a positive impact. Dairy coverage has dropped from 24% at its peak last year to 16%. This has had the effect of ‘reducing the reducers’ and the number of people who say they are cutting back on dairy has fallen to a low of 11%.(9)

However, we should not expect this respite to continue. As the vaccine is distributed through next year and the threat recedes we expect negative coverage to pick up again. The key issues of concern for consumers are health, the environment and animal welfare.

Reputational issues

Around 1 in 3 consumers have concerns about how milk is produced. Concerns tend to be generalised with ‘animal welfare’ coming up as a top consideration. However, there are some welfare specifics that are also cited particularly around cow-calf separation, the fate of bull calves, access to grazing and the erroneous belief that growth hormones and antibiotics contaminate the milk supply. More technical considerations such as mastitis or lameness are less well-known or compelling for consumers.

In addition to welfare, environmental impact of dairy production is one of the fastest growing concerns and there is growing scepticism about the environmental credentials of dairy. Five years ago, 67% of consumers felt that dairy farming was good for the countryside. That figure has now fallen to 45%. There has also been a growth in the belief that dairy farming is a contributor to climate change.(10) As more and more consumers start to consider the environmental credentials of their food it will be vital for the industry to manage communication around these issues.

Health has also been an issue during this pandemic. There has been somewhat of a paradox: on the one hand people wanted to be as healthy as possible due to fears about the pandemic, but on the other hand many people were bored, scared and frustrated which led to more indulgence. Health seems to have bounced back after a lull during the year so it is important that we can demonstrate the important role that dairy products can play in a healthy, balanced diet.(11)

Conclusion

There will continue to be structural disruption in the market next year, both from a weakened food service market, uncertainty around the levels of working from home and broader disruptions from the EU Exit. Economic challenges will be real but as a cheap and well-loved source of protein, dairy is perhaps well placed to weather some of that storm.

Producers must continue to be agile to be able to pivot route to market where necessary but there is opportunity here – the return of custom to traditional milkmen demonstrates this. They must also be innovative in exploiting both demand for more health-focused foods and also in demand for recreating food service experiences at home (in home lattes, pizza, sandwiches and desserts).

Finally, as the spectre of dairy alternatives looms it is vital that dairy producers address some of the reputational challenges, or risk more consumers dropping out of the category. The industry has demonstrated that it is possible to work together through the supply chain in responding to consumer demands in thorny issues such as bobby calves and the environment. Tomorrow’s consumer will demand even more, and will not necessarily be prepared to pay for it. There is a key need to reinforce the role of dairy in the diet and the key nutrients that it can deliver to add value for consumers.

References

1 Kantar Worldpanel Total Food and Drink | Total In Home Occasions and Total Out of Home (excl alcohol) Occasions | YOY Growth % | Rolling 12 w/e to 09 August 2020.

2 Kantar Worldpanel Plus.

3 Kantar Worldpanel / Office for National Statistics, Coronavirus and the social impacts on Great Britain.

4 Kantar Usage/TEA/coffee/ OOH sales to 6 September 2020.

5 Kantar OOH, 24we 6 Sept 2020; *Total burgers not just those with cheese.

6 AHDB/YouGov Aug 2020.

7 AHDB/YouGov 2020.

8 AHDB/Blue Marble 2020.

9 AHDB/YouGov 2020.

10 AHDB/YouGov 2020.

11 Kantar Usage.