Introduction

For over a half century, Jerry Wulf has been involved in building an integrated beef production system in the United States. We have operations in Midwestern United States that spans 3 states, Minnesota, South Dakota, and Nebraska. We started out 60 years ago as a beef cattle feeding company 20 years later adding improved genetics with registered Limousins. The Limousin bulls are used as terminal sires to produce a supply of feeder cattle coming into our finishing operations. Complimentary cross breeding, combined with heterosis, results in a supply of cattle that are very predictable, efficient, and yield a high quality carcass. Continuous improvement with genetics, technology, and good husbandry practices is then leveraged by connecting and sharing information among the segments up and down the beef supply chain through coordinated integration.

Genetics

Just as the helm of a great ship, Genetics steer the whole beef supply chain. We can remove a lot of risk by starting with proven genetics and can much more accurately predict production outcomes and cost. Without quality genetics as a starting point it is impossible to make that up and compete with superior production practices alone. While continuous genetic improvement within a breed population is a must, it can no way replace the huge genetic progress you can make in a commercial beef production system by utilizing complementary crossbreeding and heterosis. In our case we use Limousin (Terminal sire) x Angus base cows in beef cow production, and use Limousin x Jersey and Lim-Flex (Limousin x Angus) x Holstein in our commercial dairy cow production.

Data Collection

Collecting data is the basis for change and genetic progress. Traits measured in each area of production are (see Table 1 below).

Table 1

| Cow/Calf level Traits | Stocker/Feedlot Traits | Carcass/End Product Traits |

| Calving Ease | Average Daily Gain | Carcass Weight |

| Birth Weight | 365 Adjusted yearling wt. | Rib-eye size |

| 205 Adj. Weaning Wt. | Daily dry matter feed intake | Back fat |

| Milking Ability | Calculated Feed/Gain | Marbling |

| Docility | Docility | |

| $150 US | $180 US | $250 US Total = $580 |

The dollar amount shown is an estimated value difference between poor genetic cattle and superior genetic cattle. This is the opportunity to be gained with genetic improvement within each production

segment.

Genetic Tools

After measuring and collecting the data it must be analyzed and expressed in a user friendly format. The tool used for over three decades is EBV’s (Estimated Breed Values), in the US we use EPD’s(Expected Progeny Differences), both are built with basically the same formula. EBV’s and EPD’s have been a very effective tool because they remove the bias out of data. They also allow us to compile data on-going and continue to improve upon a current and existing data base. As more data is collected, analyzed, and added to the system, the accuracy of the EBV’s increase.

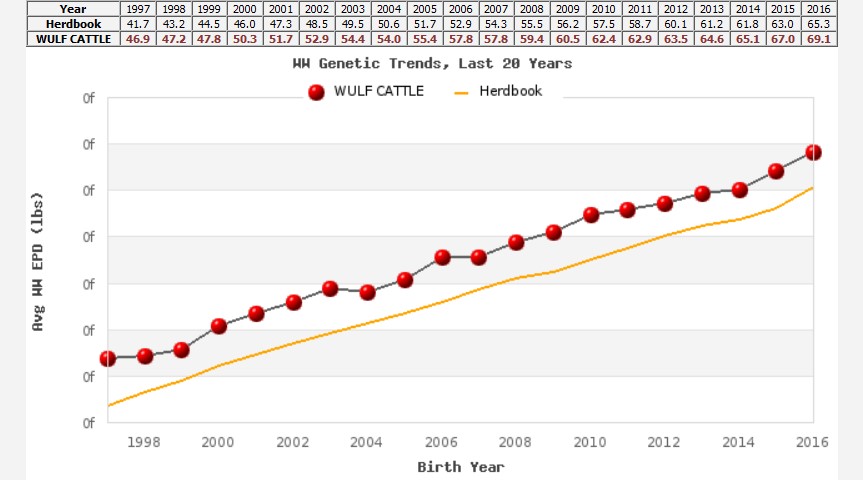

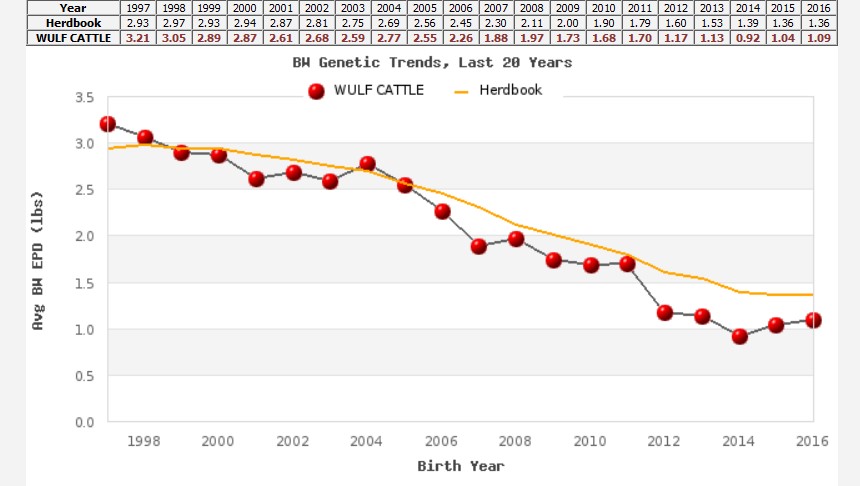

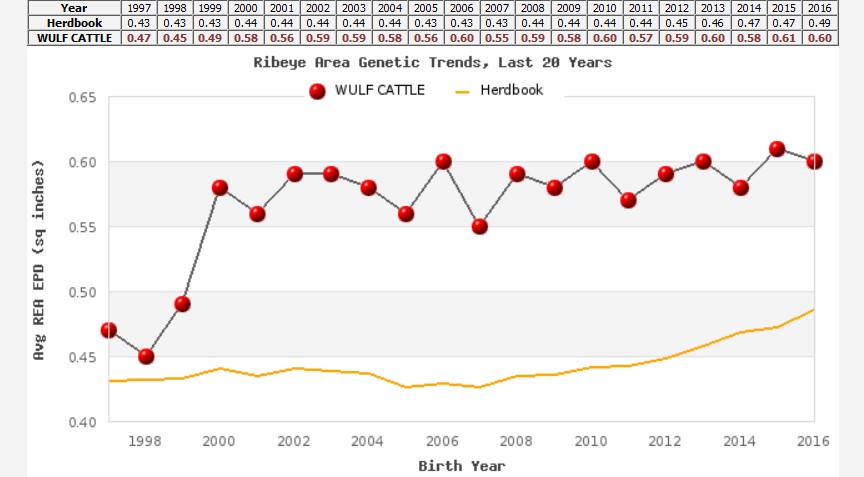

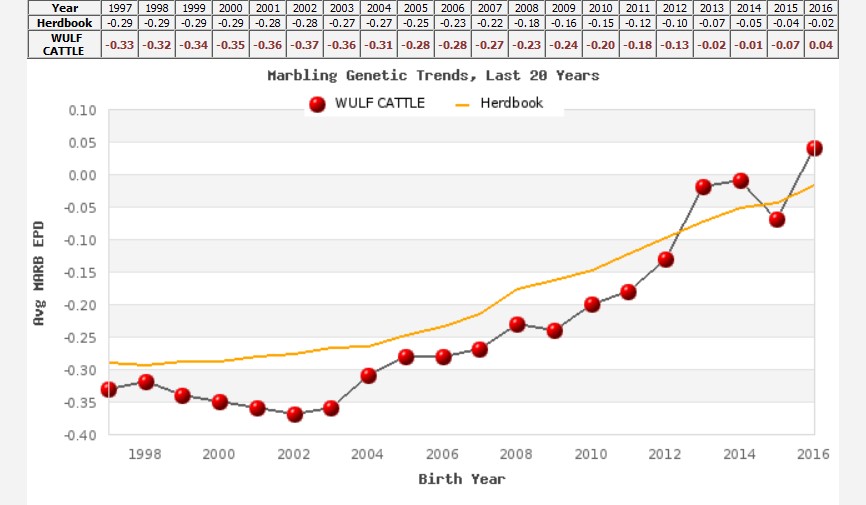

The charts in the figures depict the progress made through genetic selection in the last 2 decades, on a sample of relevant traits. See Figures 1–4.

We were able to increase weaning weight growth, while lowering birth weight.

Rib-eye size (muscle) increased while at the same time we added marbling (% intramuscular fat).

Figure 1: 205 day adjusted weaning weight (22 pound increase)

Figure 2: Birth weight decreased by over 2 pounds

Figure 3: Rib-eye size area increased by .15 square inch (Limousin is inherently heavy muscled, so less selection placed on this trait)

Figure 4: Marbling increased by .37%

Genomics

More recently a whole new world of genetic evaluation has unfolded called Genomics. It has accelerated the whole genetic prediction process. Science has allowed us to map and identify gene markers for a whole host of traits. The way we express the genomic test is through genomic enhanced EPD’s. DNA samples are collected from an animal and sent to a lab for testing. The resulting genomic prediction of the traits are incorporated with the EPD’s that the animal already had, which were derived from progeny testing or the known history of its parents progeny. The resulting genomic enhanced EPD’s have an improved accuracy on the traits measured from live cattle equivalent to having 6 progeny born and tested. On the genomic enhanced carcass traits it is equivalent to having 25 progeny tested.

So, we can now speed up the genetic improvement process by 3 to 5 years. In addition we can improve accuracy of EBV’s and EPD’s on a much more vast number of animals that likely would not have gotten progeny tested, thus upping the chances to find the outliers or superior animals by scoping a larger landscape.

Segment Concerns

Before we get into the coordination of the beef supply chain segments let’s take a look at what each segment is likely driven by when the focus is to increase margin or profitability.

Cow/Calf:

• Pounds or Kilos per calf weaned per cow exposed

• Cow maintenance requirements (How much feed is required)

• What can I get paid for my cattle? (real value)

Stocker/Finisher:

• Cattle health, death Loss

• Ability to gain

• Feed conversion Feed/Gain

• Carcass weight (Dressing percent)

• What can I get paid for my cattle? (real value)

Processor:

• Percent Red meat Yield

• Quality/Marbling

• Discounts for blemishes or outs

• What can I get paid for my beef?

Retailer/consumer:

• Great eating experience

• Consistent product size and supply

• Traceability and safety

• Good value

Segment Coordination

Note within each segment of the beef supply chain, each segment has a list of concerns that directly affect their segment and is mostly irrelevant to the other segments of the chain. Although the more each segment of the chain can better understand the other segments, and what affects their margins, the more astute they will be as to if their request can be met, and at what cost.

With that said, note the question, ‘what will we get paid?’ (In each segment). It is a direct reflection of how well the product we are producing meets or exceeds the expectation of our customer, or even our customer’s customer further up the supply chain. There is an old saying that makes this point the best, ‘It is better to have what the customer wants, than have to convince them what they need’. If we are consistently meeting or exceeding our customer’s needs we deserve to get a premium, if we are coming up short, we may merit a discount.

The following are simple steps to developing supply chain coordination:

1. Listen to our customer’s needs.

2. Build a consistent supply that fits those needs. (Stay flexible, and change as needed)

3. Agree on a risk and reward payment system that incentivizes this to happen.

4. Total transparency, share information, with each other about your product.

5. Benchmark results, allowing for continued improvement.

Each step is necessary to allow coordinated integration to happen. The following are a few thoughts I have that make it easier. First, get to know and build a relationship with the other people in the chain, especially the one who pays you for your product. Building a strong relationship requires trust, this is hard to accomplish when there is a third party (middleman) involved in sale transactions. Second is Care! Care about our customer, and be conscious that the product we are producing fits the needs of the whole supply chain, all the way to the consumer. When we think holistic, we set ourselves up to be better beef producers that are more sustainable. Plus, it is a very good story to tell that resonates well with today’s consumers.

Information Shared

As stated in the opening introduction paragraph, Wulf Cattle has been a cattle feeding/finishing operation for over 6 decades. Today, cattle-feeding is still the economic engine that drives our beef company, supported by a strong genetic component. We sell Limousin and Lim-Flex bulls to commercial beef cow ranchers. They use them to cross on their Angus based cows. Dairy Farmers buy Limousin semen to use with artificial insemination to crossbreed on their dairy cows, resulting in a much higher quality beef animal. We then purchase the resulting calves from them to finish in our feed yards, allowing us to only buy and feed cattle of known genetics.

We currently market approx. 65,000 head of fed cattle annually. All cattle are given an electronic ID tag and are traceable back to their source of origin. We track and collect data on the cattle as they go through the feedyards and onto harvest. We are able to track and collect on an individual basis both health and carcass data. The processing companies we sell fed cattle to share the carcass data back to us. We then share both health information and carcass data back to the producer of origin. We are also able to share feedyard performance (average daily gain and feed conversion) back to a select group of larger producers that are able to fill whole pens in our feedyards. When consulting with our feeder cattle suppliers, we tell them there are 3 main things that move the needle on margins for us once we have bought their calves. If they want to keep raising the bar on the quality of their cattle, they need to focus on these 3 things (see below).

Value difference from bottom 25% to top 25%

• Healthy Cattle (We track % doctored and death loss) $60 Per head

• Feed Conversion (Directly related to cost of gain) $56 Per head

• Carcass quality and yield (better the carcass, the more we get paid) $52 Per head

Total Potential value difference $168 Per Head

We then build a data bank history on the respective ranch of origins and purchase their calves using a merit based grid versus market averages. Sharing up to 1/2 of the genetic advantage we know is in their cattle and creating an incentive for our suppliers to strive for continuous improvement.

Value of Coordinated Integration

In this report we have looked at dollar value differences when comparing inferior to superior cattle. First utilizing genetic improvement, followed with the quantified added value of higher quality cattle to the finisher. While these are all opportunities for potential gain, they are not all cumulative. Though there is overlap in these comparisons, the take home message is keep building better cattle; added value can be achieved by driving cost out or getting paid more for a premium product. It is hard to quantify all the moving pieces in a beef supply chain. My estimate would be in a coordinated versus a more traditional commodity production system there is a range of $100–$150 dollars to be gained both between the cow/calf producer and the finisher, and again between the cattle finisher and the processor.

Summary

As Beef Cattle producers:

• Become part of a complete beef supply chain

• Begin with the end in mind (know your target market)

• Start with superior genetics (it is the foundation the rest is built on)

• Generate a genetic and production database (utilize today’s technology, to always improve)

• Build strong supply chain relationships (transparency is key, share information)

If we focus on these areas, I believe we will position ourselves to survive and thrive in a global food protein market that is both competitive and fast growing.